Among the ill effects-or front side experts-of becoming and traditions financial obligation-totally free is that you in the course of time provides a credit history of no. If that’s your, done well! You are unscorable, and because you will be hidden so you can borrowing whales and you may credit bureaus, you face an alternative complications: How can you convince a lending company you’re a professional borrower rather than a credit rating?

It will take a tad bit more performs-but do not give up hope. You can get home financing in the place of a credit score. Its completely beneficial. And you can we will show you just how.

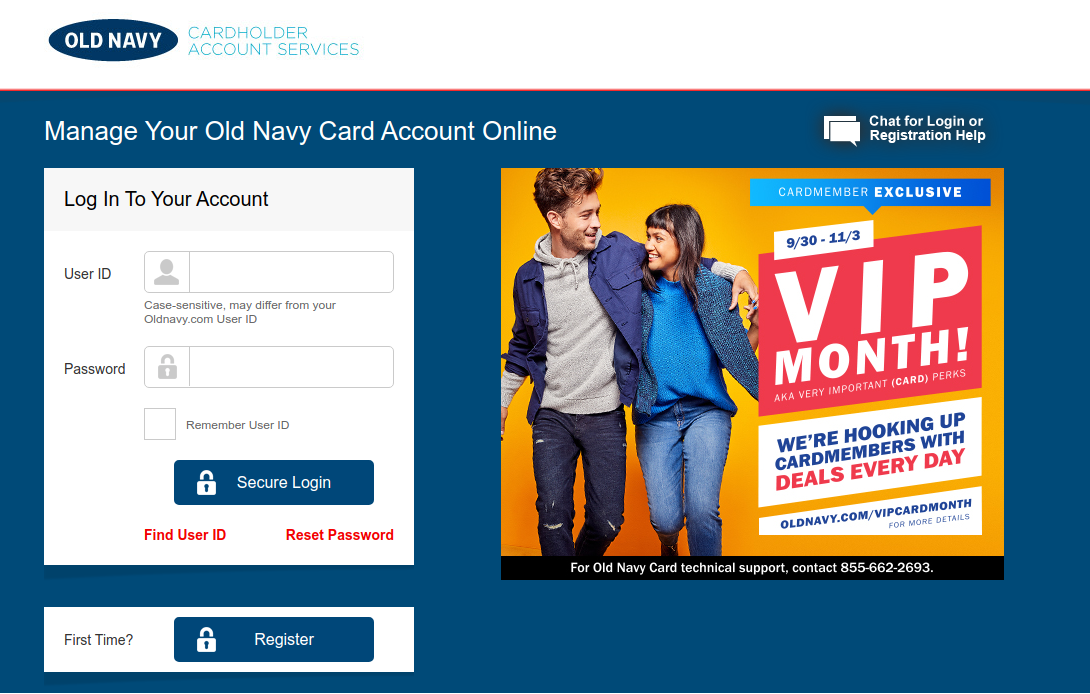

Whilst getting a mortgage in place of a credit rating means alot more files, it is not hopeless. You only need to pick a beneficial zero borrowing mortgage lender who is prepared to do something titled instructions underwriting-such as the relatives during the Churchill Home loan.

Guidelines underwriting was a give-toward analysis to your ability to pay off obligations. After all, you might be going to accept home financing, as well as your lender desires to see you can handle it.

1. Render proof money.

The initial hoop will be documents-thousands of records. You will need to tell you confirmation of your money for the last 122 years, plus a stable payment record for at least four typical month-to-month expenses. These costs cover anything from:

- Book

- Power bills perhaps not utilized in your rent repayments

- Cell phone, mobile phone or cord expenses

- Advanced payments

- Childcare or school university fees repayments

More research you can bring of one’s on the-time payment history, the greater your chances of qualifying for your mortgage.

Generally speaking, we recommend a downpayment with a minimum of 1020% of the property speed. But when you don’t have any credit score, try for 20% or more since it decreases the lender’s risk and you can demonstrates their capacity to deal with currency responsibly.

step three. Favor a great 15-12 months repaired-price conventional home loan.

No FHAs. No subprimes. Nothing but a beneficial ol’ 15-seasons repaired-speed conventional financial. And make sure your month-to-month mortgage repayments are no more 25% of your month-to-month take-family spend-along with dominant, notice, property taxation, homeowners insurance, private home loan insurance coverage (PMI) and don’t forget to take on residents association (HOA) charge. That can prevent you from are household bad! This is basically the just financial i ever highly recommend within Ramsey while the it has got the entire lower total price.

What is a credit rating?

A credit score is an effective about three-thumb count you to strategies how well your pay financial obligation. In short, a credit rating was a keen “I like debt” get. It says you’ve had debt prior to now, and you will you’ve been tremendous, modest or awful on paying it back.

Three big credit bureaus-TransUnion, Experian and you may Equifax-use borrowing-scoring patterns, including VantageScore and FICO, to build a get you to definitely range regarding 3 hundred850.

However, believe united states about this-a credit score is not proof profitable economically. Yes, you are able to see a great amount of people that feature about their credit score particularly its a come across-upwards range (“to the FICO scale, I’m a keen 850”). Don’t let yourself be conned. A credit rating will not measure your riches, money or a position position-they steps your debt.

What’s the Difference between Zero Borrowing from the bank and you will Low Borrowing from the bank?

- No credit rating: It means you prevented obligations. We enjoy which from the Ramsey because the obligations are stupid. If you’ve hit zero credit score, best wishes! And don’t forget, you could potentially however buy a property without credit history in the event the you work on a lender who does guidelines underwriting.

- Reasonable borrowing (less than perfect credit): It indicates you might have generated big money errors prior to now: You have submitted case of bankruptcy, defaulted to the property, or racked up a huge amount of credit card debt that you haven’t been in a position to repay. The lowest credit history causes it to be more difficult on the best way to find a loan provider who is prepared to make you home financing.

For those who have a reduced credit rating, pay back your entire debt, you should never miss people debts, and you can hold back until your credit score vanishes prior to trying to order a house. It’s going to be convenient to getting a home loan that have no credit score than the lowest that-believe us.

Other Home loan Alternatives for Zero Borrowing from the bank otherwise Reasonable Borrowing from the bank

For those who have no borrowing from the bank or lower than excellent borrowing from the bank, lenders can sometimes was talking you into the an enthusiastic FHA mortgage. But don’t fall for it. An enthusiastic FHA financing are a whole split-off-its a whole lot more pricey than just a traditional mortgage.

FHA loans was in fact crafted by the government and work out to invest in an excellent household more relaxing for very first-date home buyers or people that are unable to with ease be eligible for good old-fashioned mortgage.

The newest official certification on the a keen FHA loan is reduced-very reduced, in reality, that should you don’t have any credit score (otherwise a minimal credit history) as well as least an effective step three.5% deposit, it is possible to likely qualify.

On the surface, FHA fund search innocuous. What would be completely wrong that have a loan system built to help first-go out homebuyers pick house? However, in lowest-entry criteria try financing one to tons you up with big notice costs and extra financial insurance money that produce you only pay highest long-term costs.

Manage a great RamseyTrusted Mortgage lender

When you have zero credit score plus don’t need one problem whilst getting a home loan, work on the family relations at Churchill Financial who happen to be experts within creating guide underwriting. Churchill Mortgage is full of RamseyTrusted home loan experts who in fact believe in aiding you accomplish financial obligation-totally free homeownership.

Ramsey Selection could have been purchased enabling someone win back power over their funds, create money, expand the leadership skills, and you may improve their lifetime due to private creativity because 1992. Lots of people have tried our very own economic guidance courtesy 22 instructions (along with 12 national bestsellers) written by Ramsey Push, and a few syndicated radio shows and you may ten podcasts, which have over 17 billion per week audience. Get the full story.