step 1. You can find high interest levels to the a connection short-identity loan than on a conventional loan, by around 4 or 5 per cent. Therefore you should constantly keep the fresh dates you are bridging as close along with her that one can.

3. There’s a lot of files and you can hidden work that should be performed with the connection mortgage. Thankfully the work is mostly on the lenders, not brand new consumers.

That said, Wes Sudsbury explains connection financial support can make the disperse not as tiring for you as well as your attorneys. Getting important factors on step 3 pm otherwise 4 pm, immediately following being required to end up being from your home by the nine have always been or ten am, is difficult for the everyone else.

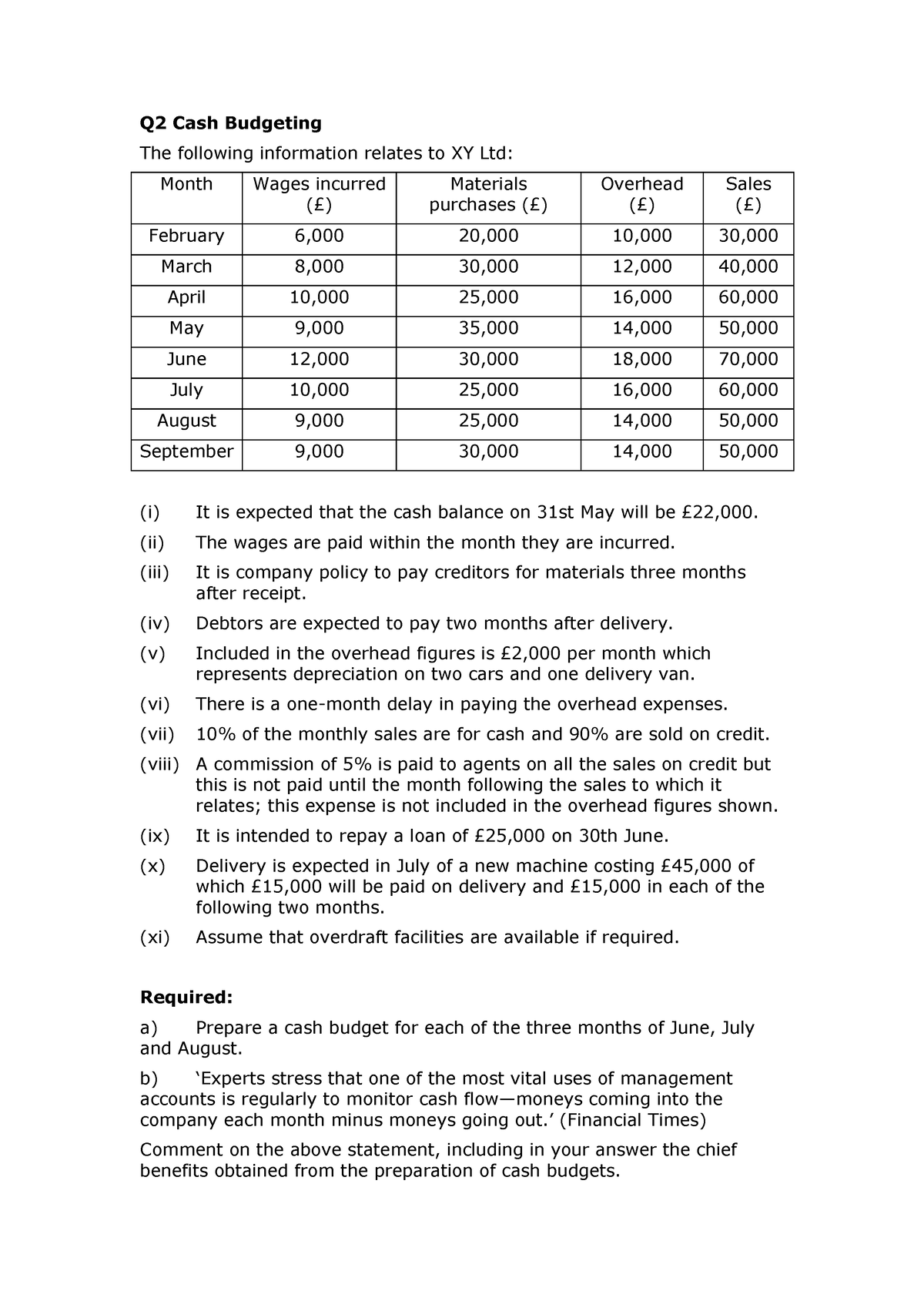

Thank goodness, there are numerous loan providers who’ll offer you home loan financial support which have a tendency to bridge the amount of time between them closure dates. This is certainly named link home loan resource.

But when you don’t possess a firm customer in line, then you’re in line to own a couple qualities to your near future. Is your money handle the worries of one’s cost of one’s first-mortgage, whenever you are dealing with mortgage repayments to your this new possessions?

5. Bridge mortgage loans what you should do if the most recent home have a strong income day?

J.D. Smythe highlights you can not link like that without a strong purchases arrangement. The lender most likely to consider and you may approve your own bridge home loan demand is the identical financial who’s got accepted the enough time-term financial support on your own brand new home. You shouldn’t expect yet another financial institution to include your having a link financial, no matter what much do you think they love your.

No one most enjoys running a connection home loan however it is an important and important product giving for the finance companies as it paves how you can a larger, meaningful a mortgage solution.

6. Bridge mortgage loans what you should do in case the most recent home has not yet sold yet ,?

In such a case, you’ll need to pick a private financial provider. Unless you, whenever you do not have the cash circulate to accomplish your purchase, you may end up in a violation out of contract condition. But, when you yourself have zero give available up until the completion off you buy, next develop you will find sufficient collateral so you’re able to resource a connection mortgage out of individual loan providers.

Reaza Ali says to be sure to query the intricate questions from anyone who you’re considering speaking about (i.elizabeth. settings fees, financial costs, discharge costs, assessment requirements, court charge, and the fee schedule typically)

Such as, Fisgard Mortgage loans bring a connection product which makes sense, fundamentally listed having home financing price cover anything from 6.99%-eight.99%, having a lender percentage are priced between 0%-step one.5%, according to certain situation. They actually do get cover toward each other features before the current assets deal.

seven. Warning names to own connection mortgage loans

Most B-lenders dont bring these financing. In case the most recent mortgage is being set-up with a b-lender, we want to avoid a beneficial mismatch out of closing times when the on most of the you’ll be able to.

Specific buyers do not require a mortgage anyway after their most recent domestic sells https://paydayloanalabama.com/napier-field/. However in that situation, your financial are unwilling to look at the issues and you can debts out-of planning a connection home loan to you personally.

says the answer, in this situation, may be to lay property Guarantee Personal line of credit (HELOC) for the the fresh purchase. Folks are satisfied, and also the borrower always keeps access to disaster fund when needed, although harmony should be reduced towards the business very they don’t have a loans once they don’t want they. points out every day life is smoother should your exact same attorney was addressing this new purchases and purchase. says I tell readers one to bringing a connection is like bringing a second recognition out of a lender. So if the borrowed funds file is actually marginal a link could be declined.