Availing of one’s NACA financing system is a very simple processes and you can involves some measures getting accompanied. The major techniques necessary to score a good NACA system financial boasts another methods.

Step 1: Doing A totally free Homeownership Conference

As you have eventually decided to go to own a great NACA financing, the first thing to perform was be involved in a no cost instructional homeownership summit towards you. Eg informative classes are often kept in the local NACA offices twice or thrice 30 days. The fresh new workshop allows you to see the costs regarding homeownership and NACA financing qualifications standards. Discover the fresh dates of these courses in your area otherwise urban area.

2: Property Therapist Conference

After you have attended the newest workshop, so now you head for the an ending up in a housing specialist. Brand new homes counselor should make it easier to pick a sufficient budget based on your money. He’s going to offer you a plan using strategies and tips to be financially stable to start brand new NACA home buying program.

Once completing the fresh new given plan, it could take several months becoming NACA-licensed. It will always be advised so you’re able to declaration the fresh new progress towards counselor unless you is fully formal.

Step 3: Maintain your Profit And you can Complete the necessity away from Lowest Deals

After recognized, the latest NACA degree is legitimate having ninety days. Thus, immediately after become authoritative from the NACA, you may have a number of responsibilities to satisfy:

- Control your income

- Build quick repayments of expense

- Refrain from trying out brand new obligations

- An amount comparable to your existing housing payment without the next mortgage number should be conserved monthly.

At NACA, buy classes take place most of the Thursday out of six p.yards. so you’re able to 7:29 p.m. You ought to sit-in that workshop since it can help you to find services which come about a number of the reasonable rates loan in Panola Alabama. In addition to, you could bring help from a great NACA-recognized real estate agent to look for a home.

After picking out the household you are looking for to find, you need to get a home degree letter out of your houses counselor. You can also grab assistance from the actual home representative during the drafting a deal letter, bringing up the needs for renovations otherwise repairs.

Action 6: Obtain the Family Examined

2nd, you are going to need to schedule a house assessment having an effective NACA-accepted household inspector to help you be eligible for the borrowed funds. Additionally, it may were a pest review, safety rules, or people health insurance and framework trouble. Or no concern is understood, it must be fixed ahead of moving into our house.

Action seven: Search Home loan Consultancy And you may Complete Your loan Investigation

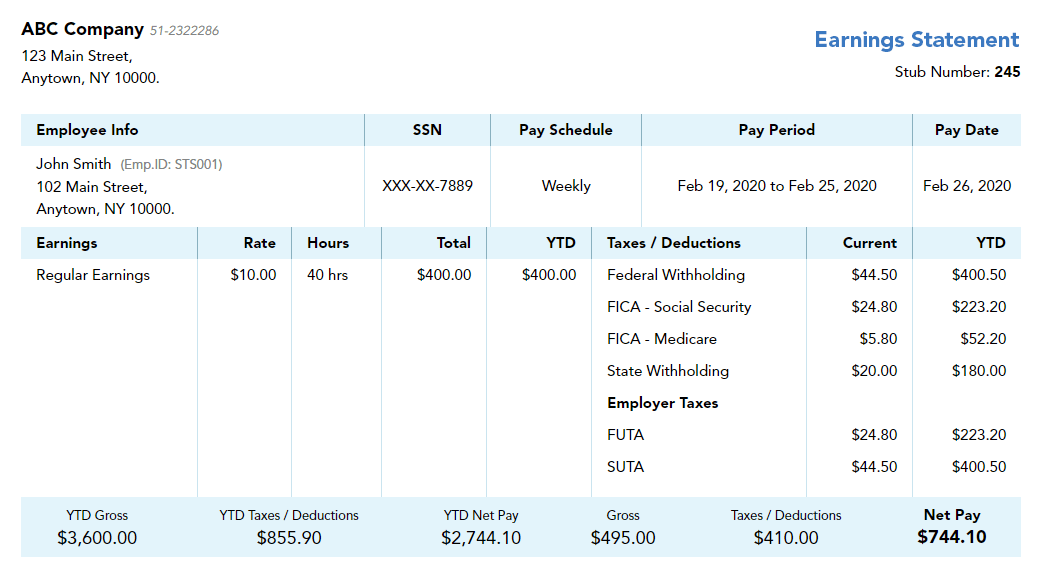

Now happens new action in order to officially applying for a beneficial NACA mortgage. To confirm yourself as the NACA-accredited, you may be requested to show you to minimum rescuing conditions are fulfilled, in addition to earnings are handled instead of trying out the brand new obligations. Next, you are going to need to complete the next data files to be considering into financial:

- Sales package and additionally a keen done purchase

- Pay stubs of your history 1 month

- When it comes to notice-a career, lender statements the past one year.

- All of your current accounts’ bank statements going back 90 days

- Recognition off quick leasing money

Action 8: Expect Your own Home loan To close off

Look out for the insurance to own home owners and keep your finances the necessary repairs and you will renovations; up to the mortgage becomes processed totally.

Step 9: Financial Closing

NACA funds require no settlement costs, but really you really need to introduce a legitimate have a look at showing expenses eg prepaid service taxation. At the closure, you’ll meet the household supplier, the seller’s lawyer and/otherwise representative, your agent, the fresh lender’s attorney otherwise settlement broker, as well as your attorney to ensure the loan data and you will secure the new deal.