S. Department of Farming (USDA) has the benefit of loans if you are old, disabled, low-income otherwise People in the us residing outlying metropolises

The federal and state governing bodies render guidance in almost any forms. Information are available to result in the homebuying process alot more manageable, including tax-totally free discounts is the reason individuals with disabilities, guidance of rescuing to own a downpayment and construction pointers away from the new U.S. Department regarding Casing and Urban Advancement.

Us Service away from Agriculture

The new U. USDA financing do not require an advance payment like other mortgage items. A few different types of USDA mortgage brokers allow for modification so you’re able to a house or a mortgage having another type of household. Recall speedycashloan.net/loans/payday-loans-for-the-unemployed there is a list of requirements getting qualified to receive a great USDA financing.

Discover three kind of USDA property funds: Single-Loved ones Construction Head Lenders, Part 502 Secured Rural Property Loan and you will Area 504 Domestic Fix System. The first a couple of loans assist lowest-money consumers score mortgage loans getting terms between 29 to help you 38 ages fixed. The house repair financing allows investment to have domestic solutions and you may advancements.

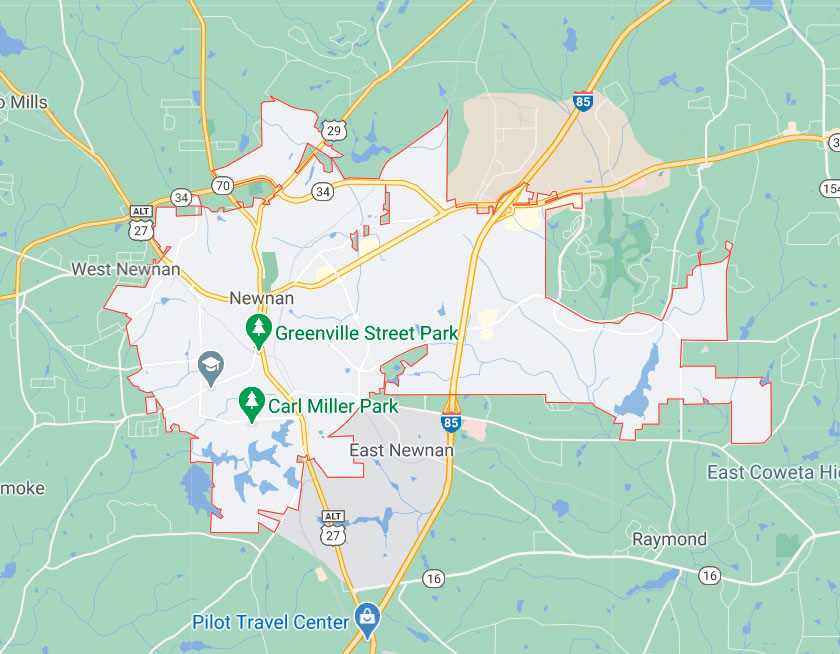

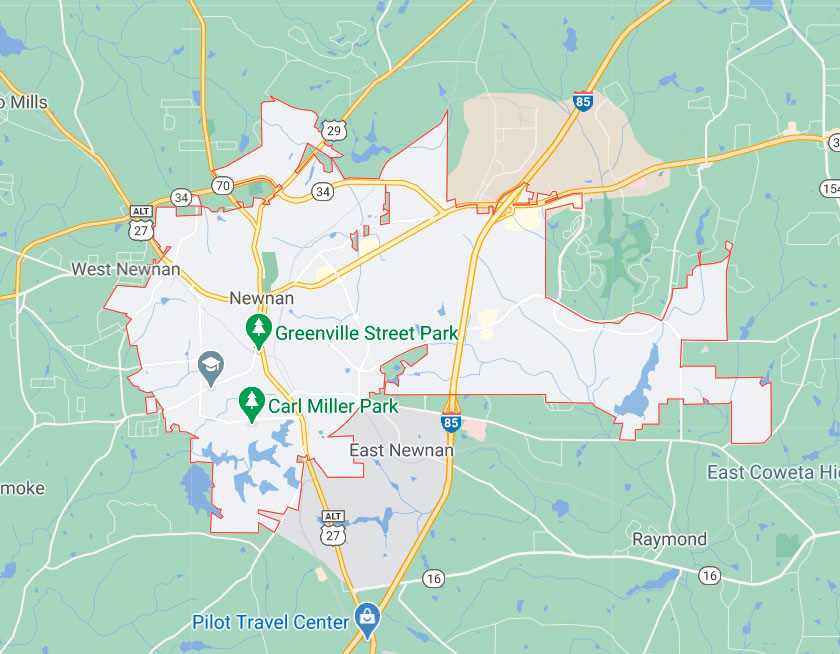

Requirements having good USDA financing become earnings requirements, and you may a candidate must be in the place of a safe, hygienic spot to alive. You ought to meet citizenship requirements and you will intend to invade the house as your first home. There are even assets standards, and additionally which have to be dos,100000 sqft otherwise quicker plus a rural town with a population around thirty-five,one hundred thousand. Continuar lectura →